How to register your Canadian IT Business Corporation, create a Name and open Tax Accounts

Think of Incorporating your IT business, plan to do it yourself and do it right?

Easy steps to create a private company taking care of specifics in freelance professional work.

Basic aspects of Business Corporation registration and start of operation by the independent IT

contractor working to take their business to the new level.

1. Making Choice between Federal and Provincial Corporation

FEDERAL CORPORATION

- Cost of Registration: Cost to incorporate online is $ 200 payable at the end of the process of online registration

by Credit Card or other online payment options. By mail: $ 250.

Corporations Canada

Industry Canada

235 Queen Street

Ottawa ON K1A 0H5

Telephone:613-941-9042

Fax: 343-291-3409

Toll free: 1-866-333-5556

- Extra-provincial Registration Fees:

Federal Corporations must also apply for provincial

registration in the province of their location. The Fees for provincial registration vary from province to province.

Currently there is no fee for such registration in Ontario.

Newfoundland.......................$560

Prince Edward Island............$260

New Brunswick.....................$212

Nova Scotia..........................$252

Quebec................................$308

Ontario.................................No cost

Saskatchewan......................$340 (Provincial name search of $75 included)

Manitoba..............................$349 (Provincial name search of $49 included)

Alberta.................................$395

Northwest Territories.............$300

Yukon Territory.....................$335

British Columbia...................$391 (Provincial name search of $39 included)

- Corporate Name: NUANS Name Search Report is required in order to register Corporation under a Business Name. Cost is about $ 30 for NUANS Federal Name Search.

It is important to realize that since a Federal Corporation reserves its name nation-wide, there is much closer examination

of the proposed business name and any existing name similarities by the registrar.

In case the proposed name of a Federal Corporation closely matches with any existing corporate names, registration under

that name can be blocked by the authorities.

- Annual Fees: Annual Return is to be submitted to Industry Canada each year within 60 days after the year-end, and

is filed separately from Corporate Tax Return online or by mailing a completed form. The return contains information about corporation's address, directors and annual meeting.

Fee for online filing is 20 dollars, the cost of filing paper return is 40 dollars.

- Length of registration process: If registered online, the certificate of incorporation is emailed in form of Adobe Acrobat file within the next 24 hours.

Registration by mail takes about two weeks.

- Tax Filing Requirements:

Tax filing requirements are same for Federal and Provincial Corporations and include but not limited to:

- Filing T2 Corporate income Tax Return within six month period after the year end

- Filing HST Returns by the due date as specified by CRA

- Filing T4, T5, and other required forms with the CRA

See detailed information on HST, Corporate Tax, T4, T5 and other tax filing requirements for typical IT Corporation

- Restrictions on types of business the corporation may do:

Federal Corporation can do business in any province as well as internationally and its business name is protected

nation wide.

- Amendments to corporation's charter: The corporation may amend its charter to change its business name or other charter provisions. Cost of such

amendment for Federal Corporation is $ 200.

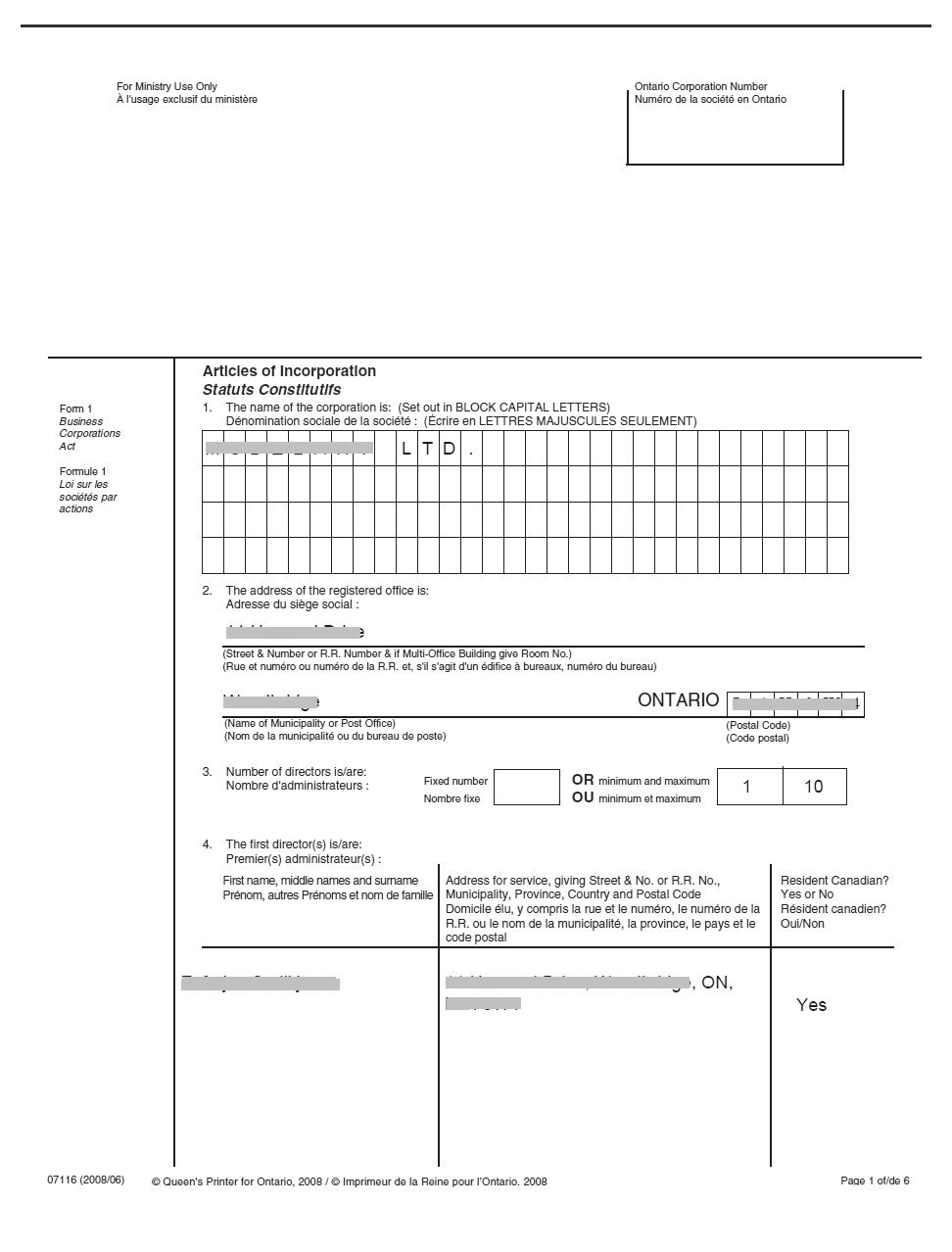

PROVINCIAL CORPORATION

- Cost of Registration: Cost to incorporate online is $ 330 payable at the end of the process of online registration

by Credit Card or other online payment options. In person or by mail: $ 360.

Ministry of Government Services

Companies and Personal Property Security Branch

Suite 200

393 University Ave

Toronto ON M5G 2M2

- Annual Fees: Annual Return is submitted to Canada Revenue Agency each year on Schedule 546 as part of T2 Corporate Tax Return.

Canada Revenue Agency files the return with Ministry of Government Services upon receipt.

The return contains information about corporation's address, directors and annual meeting. There is no fee for filing annual

return by Ontario Corporation.

- Length of registration process: Registration by in person takes place immediately when the Articles of incorporation

are accepted by the Companies and Personal Property Security Branch at:

393 University Ave., Suite 200

Toronto ON M5G 2M2

and the incorporator receives copy of the Articles of incorporation stamped by the ministry.

If registered online, the certificate of incorporation is emailed in form of Adobe Acrobat file within the next 24

hours. Registration by mail takes about two weeks.

- Tax Filing Requirements:

As mentioned above, tax filing requirements are same for Federal and Provincial Corporations and include but not limited to:

- Filing T2 Corporate income Tax Return within six month period after the year end

- Filing HST Returns by the due date as specified by CRA

- Filing T4, T5, and other required forms with the CRA

Follow this link for HST, Corporate Tax, T4, T5 requirements for typical IT Corporation

- Restrictions on types of business the corporation may do:

Provincial corporation can do business in any province as well as internationally and its business name is protected

province wide.

- Amendments to corporation's charter: The corporation may amend its charter to change its business name or other charter provisions. Cost of such amendment for

Ontario Corporation is $ 150.

CONCLUSION: Considering the example of Ontario-based business, Federal corporation has lower registration cost, however it may not always be possible to incorporate federally under desired business name. If the proposed business

name is disallowed for federal incorporation, the Ontario Corporation would be the better choice as it places less restrictions on business name choice. Ontario Corporation can do business internationally or anywhere in Canada. Below

you can find step by step description of registration process for Federal, and Provincial Corporation.

2. Preparation for Registration

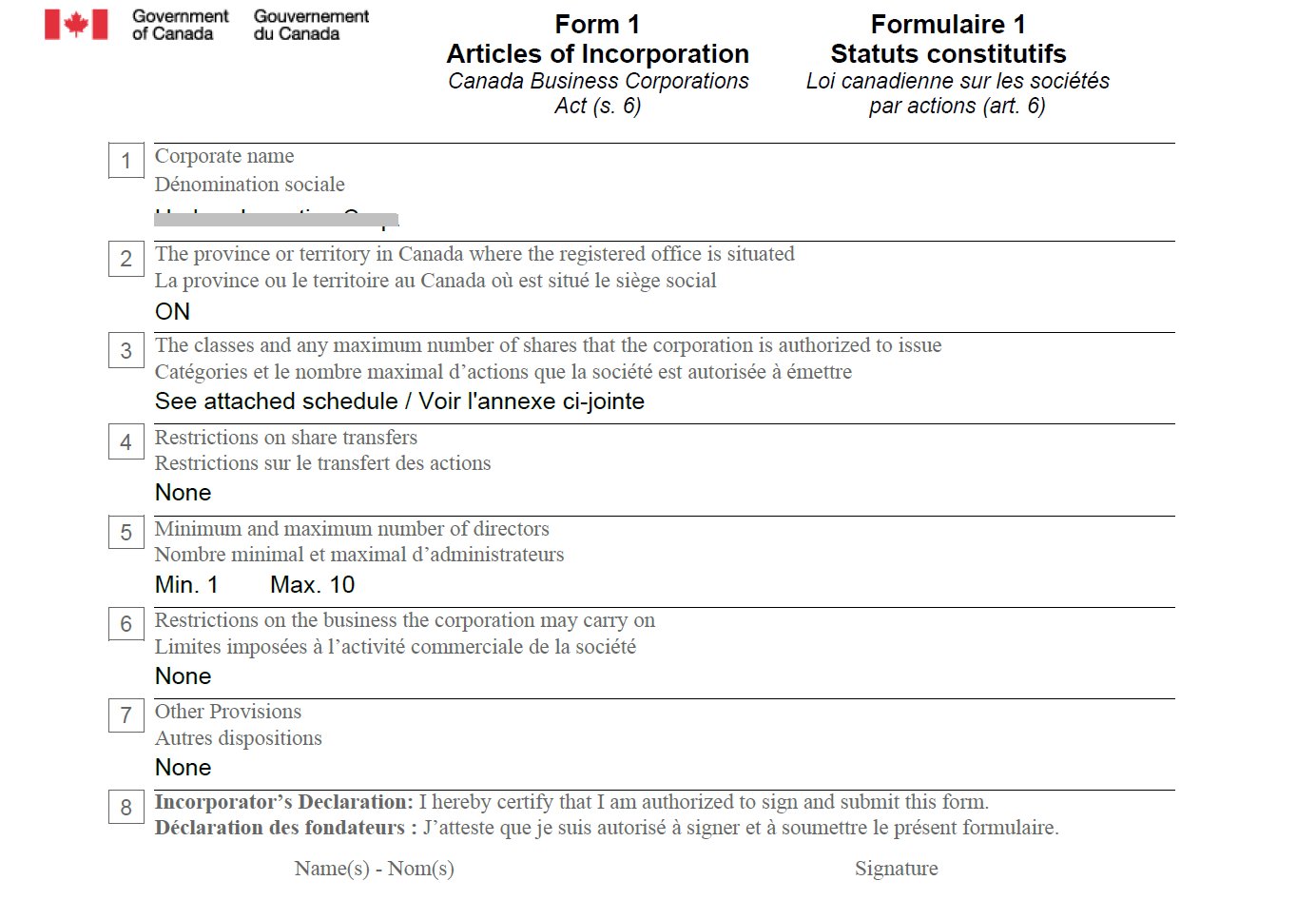

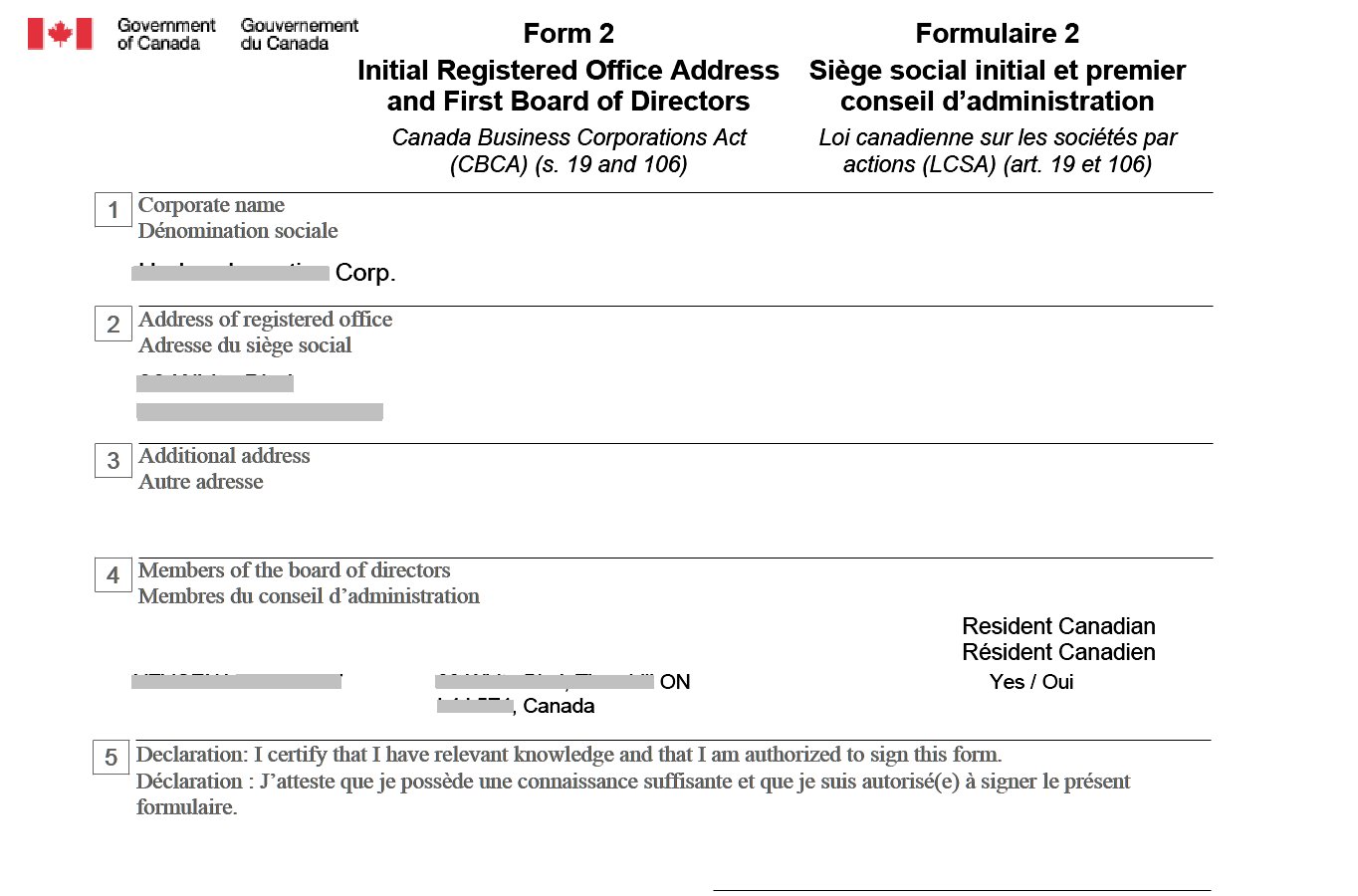

PROVISIONS OF THE ARTICLES OF INCORPORATION

This article expressly excludes any questions related to the provisions of the articles of incorporation as its main focus

is on technical process of corporate registration only. Different situations require different approach to various articles provisions

that can be complex and describe in detail such matters as shareholders rights and privileges, classes of shares and

how they can be issued, along

with other matters that can be important for future corporation's activities.

The single owner/director corporation founded by IT Professional, taken as an example and referred to in this article, in most cases will not require any

specific articles provisions. Corporation's charter can also be changed after incorporation for a fee as indicated above. The readers, however, are cautioned and should agree that by using any of the information

provided in this article they take full legal and financial responsibility for their actions.

NUANS NAME SEARCH

The corporation can be formed with a business name, or without such. When no name is proposed, a seven-digit number assigned by registrar,

followed by "Canada Inc." or "Ontario Inc." is designated as corporation's name. For example: 1237654 CANADA Inc., or 9638520 Ontario Ltd. The corporate name can end with either:

Inc.

Ltd.

Corp.

Incorporated

Limited

Corporation

IT businesses are generally advised by their accountants to register with a business name due to "

Personal Services Corporation"

concern.

In that case NUANS name search is required at the time of incorporation. The document is an official report that contains a list of same or similar names.

Federal incorporation requires Federal NUANS report, while provincial NUANS report is needed for provincial registration. Below is an image of the title page

of a sample Federal report:

The document can be ordered online for the price of about $25 plus tax in its most basic version. Services such as Arvic.com also offer three free preliminary searches

that allow to make sure the business name is available. Note that pre-search report is less detailed. Once ordered, the Adobe Acrobat report file takes about 24 hours to be delivered to

provided email address.

3. Registration Procedures

PROCESS OF REGISTRATION for FEDERAL CORPORATION:

Follow the link to Industry Canada Online Filing Centre

https://www.ic.gc.ca/app/scr/cc/CorporationsCanada/hm.html?locale=en_CA ,

or google "register federal corporation online" to get to screen pictured below: